Georgetown, Guyana

Guyana Co-operative Credit Union League Ltd

Wednesday 13th & Thursday 14th, September 2023

| |

1) CREDIT MANAGEMENT – LOANS... OPPORTUNITIES AHEAD!

The issue now faces many lending organisations is one of value proposition, that is, how can we rebuild the fortunes once enjoyed before the Pandemic!!

Loans remain the primary and dominant income generator for many or all deposit-taking and lending institutions, as such loan growth/expansion (and quality) will undoubtedly occupy the minds of directors, managers and lending officers.

This year’s Effective Credit Management Two Day Workshop will focus on leveraging on the Opportunities Ahead to influence the entity’s Value Proposition – This will be accomplished through quality loan Growth Strategies.

The pandemic has propelled business models into more of an outsourced paradigm, which resulted in a proliferation of entrepreneurs and independent service providers – are these growth opportunities being leveraged by organisations?

Effective Credit Management remains the “Foundation of Your Business”, as without credit through loans to customers/ members, the financial institutions will be unable to:

|

In capitalising on Opportunities Ahead, the 2023 two day Effective Credit Management Workshop will focus on:

|

2) PREVIOUS PARTICIPANTS TESTIMONIALS

This two-day Effective Credit Management workshop improves organisational effectiveness so that organisations can:

Protect and expand their loan portfolio. Increase Income

Enhance asset quality.

Strategically respond to IFRS 9 – minimize loan provision. Employ a combination of various strategies to boost loan portfolios.

Adopt underwriting techniques to ensure productive loans

Apply workable recovery tools and techniques to enhance collections.

Be aware of credit market dynamics to penetrate niche markets, especially business loans. Perform financial analysis and calculate ratios on borrowers’ financial statements.

Be aware of the requirements of Credit Risk Management Framework as tool for Credit Underwriting

Apply workable recovery tools and techniques to enhance collections. Employ sound credit management practices.

Be aware of Technological Techniques in Credit Management.

Protect and expand their loan portfolio. Increase Income

Enhance asset quality.

Strategically respond to IFRS 9 – minimize loan provision. Employ a combination of various strategies to boost loan portfolios.

Adopt underwriting techniques to ensure productive loans

Apply workable recovery tools and techniques to enhance collections.

Be aware of credit market dynamics to penetrate niche markets, especially business loans. Perform financial analysis and calculate ratios on borrowers’ financial statements.

Be aware of the requirements of Credit Risk Management Framework as tool for Credit Underwriting

Apply workable recovery tools and techniques to enhance collections. Employ sound credit management practices.

Be aware of Technological Techniques in Credit Management.

3) DELIVERABLES AND OBJECTIVES

In addition to participants’ exposure on two days of expert facilitation, participants will be provided with:

|

After participating in this Two-Day Effective Credit Management Workshop, participants will be able to:

|

4) TARGET AUDIENCE

|

|

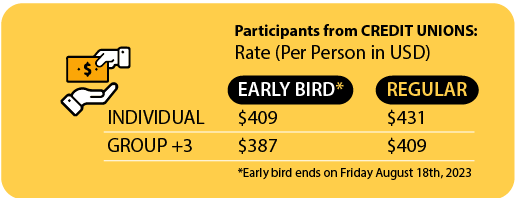

5) PRICES PER PERSON FOR BOTH DAYS

|